Etsy + QuickBooks + TurboTax: A CPA-Approved Playbook for Profitable, Low-Stress Selling

CPA’s Quick Take:

- Connect Etsy → QuickBooks Online with Intuit’s “Sync with Etsy” app to auto-import sales, refunds, fees, and deposits. It backfills to Jan 1 of the prior calendar year and then checks for new activity about every 3 hours. QuickBooks

- QuickBooks Self-Employed (QBSE) isn’t offered to new users anymore; steer new sellers to QuickBooks Solopreneur/Online (existing QBSE users can keep it). QuickBooks+1

- TurboTax now supports 1099-K “Snap & Autofill” on mobile, and it walks Etsy sellers through reporting Schedule C income and deductions. TurboTax

- The IRS is phasing in 1099-K thresholds: $5,000 for 2024, $2,500 for 2025, then $600 from 2026 (you must report income regardless). IRS+1

⚠️ Disclosure: This guide includes information with affiliate links that pay a commission to CPAatLarge.com at no extra cost to readers.

Why this matters right now

Etsy is still a huge engine for micro-business. In 2024 the company reported $12.6B in consolidated GMS (with $10.9B from the Etsy marketplace itself), and as of Q2 2025 there were ~5.4M active Etsy marketplace sellers (8.1M consolidated sellers including Depop at the time). That’s a lot of creative entrepreneurs who need clean books and painless taxes. investors.etsy.com+1Securities and Exchange Commission

Clean financials are the difference between “I think I made money” and actually paying yourself. The good news: Etsy, QuickBooks, and TurboTax now play together far better than they used to.

How QuickBooks works with Etsy (the right way)

Use the official “Sync with Etsy” app for QuickBooks Online. After you pick your import start date (you can go back to Jan 1 of the prior calendar year), the app brings in your sales, refunds, fees, and deposits, auto-categorizes them to an “Etsy <shop name>” clearing bank, and sets up sensible income/expense accounts. After that first import, it checks Etsy every ~3 hours. QuickBooks

What it does (and doesn’t) pull:

- Pulls: sales receipts, refunds, listing/transaction/ads/subscription fees, deposits and merchant charges—mapped to dedicated accounts so your P&L makes sense.

- Doesn’t pull: item-level product details or individual customer names—Etsy is treated as the customer/vendor for clarity. (That’s normal and good for reconciliation.) QuickBooks

CPA Tip: On first connect, start from the first day of a month to keep reconciliation tidy. If you import past months, review duplicates—QuickBooks explains how to adjust if you already entered some transactions manually. QuickBooks

Two-store sellers? QuickBooks notes the built-in app is one-shop-per-QBO-company. If you run multiple Etsy shops, consider either separate QBO companies or a third-party summarizer like A2X or Synder that posts clean payout summaries and scales to multiple channels. QuickBooksA2X AccountingSynder

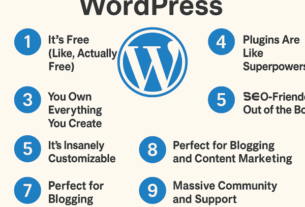

QuickBooks Self-Employed vs. QuickBooks Solopreneur/Online

Intuit confirmed QuickBooks Self-Employed is no longer sold to new subscribers (existing users can continue). New Etsy sellers should use QuickBooks Solopreneur or another QuickBooks Online SKU depending on needs (inventory, classes/locations, etc.). QuickBooks+1

CPA Tip: If you sell physical goods and track cost of goods sold (COGS), pick a QBO plan that supports products and inventory workflows. Pair with A2X/Synder if you need channel-by-channel summaries. A2X Accounting+1

TurboTax + Etsy income: what actually happens at filing time

Where Etsy shows up: TurboTax routes Etsy income and expenses to Schedule C. You can input Etsy totals (or 1099-K amounts) and then deduct fees, shipping labels, advertising, packaging, home office, mileage, etc. TurboTax’s guides for Etsy sellers walk you through that step-by-step. TurboTax

1099-K thresholds (do not ignore):

- Tax year 2024: 1099-K required at $5,000+ in gross payments (card/app/marketplace).

- Tax year 2025: $2,500 threshold.

- 2026+: $600 threshold slated.

You must report income even if you don’t receive a form. IRS+1

Handy time-saver: TurboTax supports 1099-K Snap & Autofill on mobile—scan the form and it prefills fields for you. (Still review for accuracy.) TurboTax

About QuickBooks → TurboTax data flows: Legacy QBSE had a direct TurboTax handoff. If you’re on QuickBooks Online, there isn’t a direct one-click import to TurboTax Online; you’ll pull reports and enter totals (or use the 1099-K as your gross and back out fees/COGS). QuickBooks+1

Etsy fees, pricing math, and what sellers really take home

Here’s the short, accurate version you can paste into any product spreadsheet:

- Listing fee: $0.20 per listing.

- Transaction fee: 6.5% of item price + shipping + gift wrap (U.S. sellers: sales tax excluded from this fee). Etsy+1

- Payment processing: varies by country; in the U.S. it’s commonly 3% + $0.25 per order. Etsy HelpEtsy

- Offsite Ads: 15% if your trailing 365-day shop revenue is under $10k, 12% if $10k+ (fee capped at $100/order and only when the sale is attributed to an offsite ad). Etsy Help

One-line profit check:Net = Price – (Materials + Packaging + Labor) – (6.5% + processing + Offsite Ads if applicable) – Shipping label – Overhead

CPA Tip: Model with and without Offsite Ads attribution so you don’t underprice. QuickBooks categories should mirror this formula so your P&L tells the truth.

Real ways people make money on Etsy (and how the books look)

- Digital products (printables, SVGs, Canva templates)

- Why it works: near-zero COGS per unit, scalable.

- Accounting view: all revenue sits in Etsy Shop Sales; fees hit Etsy Shop Fees; almost no COGS. Great for high-margin side income once listings rank.

- TurboTax angle: watch for home office, software, design assets.

- Print-on-demand (POD) (Printful/Printify)

- Why it works: no inventory to carry; the provider is your COGS at fulfillment.

- Accounting: map POD charges to COGS: Production; keep shipping paid by buyers separate from shipping label costs; fees remain in the Etsy fee buckets.

- Handmade/physical goods

- Why it works: defensible designs and brand.

- Accounting: track materials inventory (even if simple), record COGS when orders ship; capitalize tools/equipment; watch your labor rate—it’s where margins quietly disappear.

Proof you’re running a business: monthly reconciliation of your Etsy clearing account to Etsy Monthly Statements (downloadable from Shop Manager → Finances → Monthly statements). Keep the CSVs; they’re gold at tax time. Etsy Help

10-Minute Setup Checklist (books → taxes)

- Open QuickBooks Online/Solopreneur

- Create bank accounts in QBO for:

- Etsy clearing (the app adds this)

- Your checking for Etsy deposits

- Your card if Etsy charges fees there (optional) QuickBooks

- Install “Sync with Etsy” in QBO, choose import start date (Jan 1 prior year if needed), connect shop, and let it run. QuickBooks

- Reconcile this month’s Etsy clearing to your Monthly Statement and match deposits to your bank feed. QuickBooks

- Turn on a receipts workflow (email-to-QuickBooks or a folder you post from weekly).

- Quarterly routine: review P&L and cash flow; set aside estimated taxes (TurboTax has planners if you filed with them last year). TurboTax

- At tax time: if you have a 1099-K, use Snap & Autofill on TurboTax mobile; then enter expenses from QuickBooks reports (or your A2X/Synder summaries). TurboTax

Audit-proofing box: Keep your Etsy Monthly Statement CSVs, shipping label receipts, and a year-end inventory count. Export Etsy data from Shop Manager → Settings → Options → Download Data if you need detailed backup. Etsy Help

Alternatives that scale (A2X & Synder)

If you sell in multiple channels or want payout-level summaries instead of per-transaction imports, tools like A2X and Synder summarize Etsy sales/fees/taxes into clean journal entries that match bank deposits with one click—great for reconciliation and month-end sanity.

FAQ (fast answers)

Can I still use QuickBooks Self-Employed with Etsy?

Yes—if you already have it. New users should choose Solopreneur/Online. QuickBooks

How far back will the QuickBooks Etsy app import?

To Jan 1 of the previous calendar year—you choose the start date during setup. QuickBooks

Do I have to report Etsy income if I didn’t get a 1099-K?

Yes. The thresholds are phasing in, but income is taxable either way. IRS

Does QuickBooks Online push my numbers into TurboTax automatically?

Not directly. You’ll use reports/1099-K and enter into TurboTax (QBSE had a direct handoff). QuickBooks

Bonus: exporting Etsy data (if a reader prefers manual bookkeeping)

From Shop Manager → Settings → Options → Download Data, you can export orders/sold items/monthly statements as CSV. It’s not as fast as the app, but it’s the right fallback. Etsy Help+1