Recession. It’s the word that can send a shiver down your spine or just make you sigh, depending on how prepared you feel. While we can’t always predict exactly when a recession will hit, we can prepare in ways that cushion the blow—whether you live in a bustling city, a small town, or a rural area; whether you’re a salaried employee, a gig worker, or a retiree.

This guide walks you through how to prepare for a recession in different scenarios, covering earning, saving, spending, and investing strategies. Think of it as your recession-proofing playbook—personalized to your situation.

What Is a Recession, and Why Does It Matter?

Let’s quickly recap: A recession is typically defined as two consecutive quarters of declining GDP. That translates to fewer jobs, lower incomes, shrinking investments, and sometimes tighter credit. While some sectors are hit harder than others, nearly everyone feels the ripple effects—so it pays (literally) to be ready.

10 Universal Steps to Strengthen Your Finances in Any Recession

No matter your income, job type, or where you live, these 10 essential steps can make a huge difference. They form a solid foundation that helps everyone weather a recession.

1️⃣ Create or Strengthen Your Emergency Fund.

Aim for at least 3–6 months of essential expenses. Even small, consistent contributions matter. Try apps like Acorns or Qapital to automate savings.

2️⃣ Cut Unnecessary Expenses Ruthlessly.

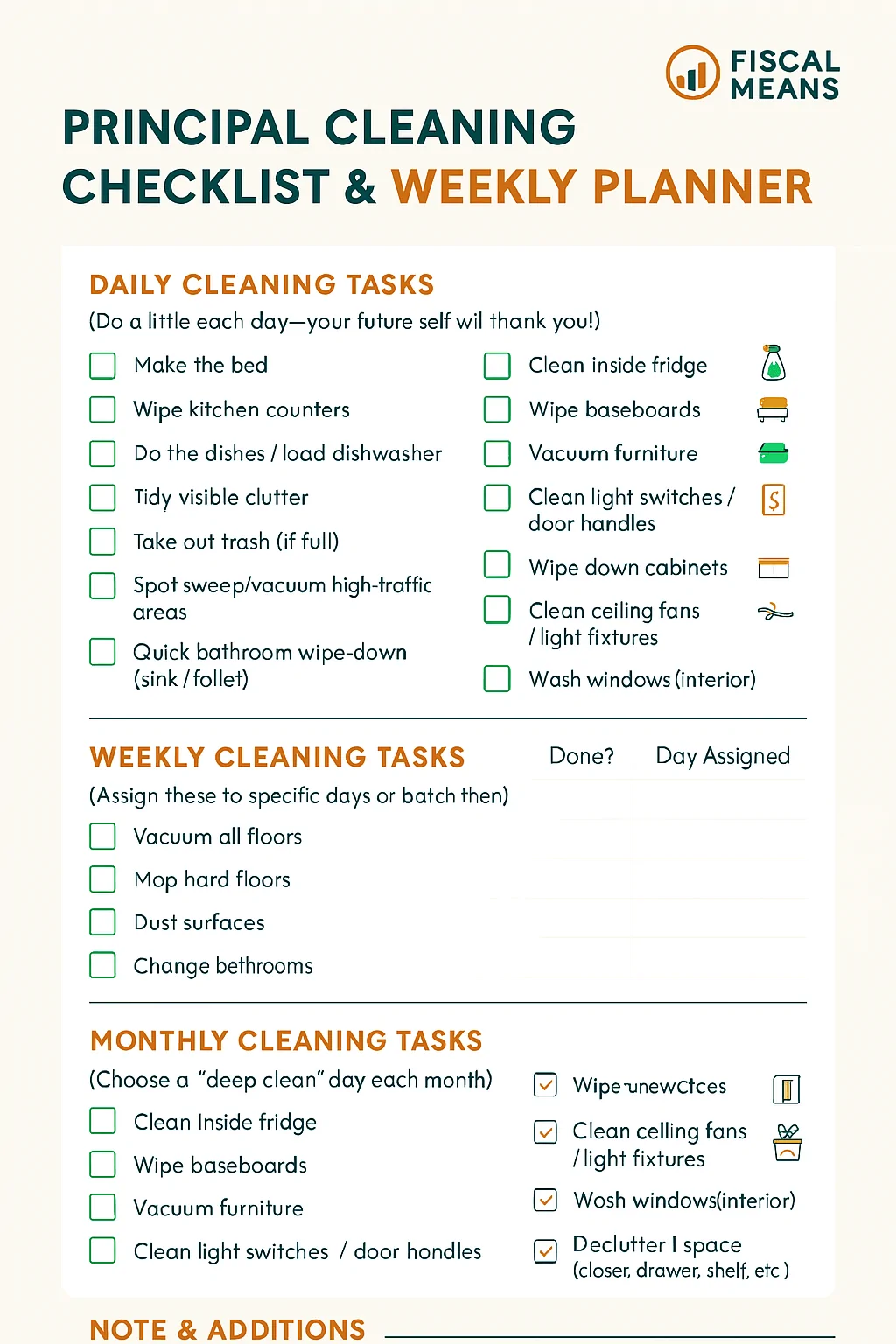

Do a “money audit” every 30 days: cancel unused subscriptions, downgrade services, and compare utility providers. Use a budgeting notebook or an app to track your wins (affiliate link idea).

3️⃣ Get (and Stay) Out of High-Interest Debt.

Aggressively pay down credit card balances and avoid taking on new high-interest debt unless absolutely necessary.

4️⃣ Stock Up on Essentials.

Buy non-perishable foods, toiletries, and household supplies when they’re on sale. A pantry inventory sheet can help you stay organized (affiliate idea: meal prep containers).

5️⃣ Diversify Your Income Streams.

Whether it’s freelancing, selling on Etsy, or offering tutoring services, find a side hustle that fits your lifestyle.

6️⃣ Update Your Resume and LinkedIn Profile.

Always be job-ready, even if you feel secure now. Keep networking—your next opportunity may come from an unexpected place.

7️⃣ Learn Basic DIY Skills.

From home repairs to car maintenance, learning how to fix things can save hundreds—or thousands—over time. (Affiliate idea: DIY repair kits or how-to guides.)

8️⃣ Prioritize Health and Insurance.

Make sure your health insurance is up to date and consider a wellness checkup. Preventive care is cheaper than unexpected medical bills.

9️⃣ Invest in Yourself.

Take online courses or read books that build your skills. Knowledge pays off long-term. (Affiliate: “The Lean Startup”, “Atomic Habits”.)

🔟 Stay Calm and Avoid Emotional Spending.

Money stress can lead to poor decisions. Build mindfulness practices—breathing exercises, journaling, or simply unplugging from financial news cycles.

1️⃣ Low-Income Urban Workers: Focus on Security and Flexibility

Example Scenario: You live in a city, work in retail or food service, and rent an apartment.

Earning

Urban centers often see layoffs in service industries during recessions. Now’s the time to upskill. Free or low-cost online certifications in areas like digital marketing, coding, or healthcare support can help you transition if needed.

Saving

Even if you’re on a tight budget, aim for a $500-$1,000 emergency fund. Apps like Qapital or Acorns make micro-saving possible without feeling the pinch.

Spending

Cut what’s easiest first: subscription services, eating out, and premium plans. A budgeting journal (Amazon link) helps you track expenses and stay honest.

Investing

Focus on liquidity. Keep retirement contributions if possible, but avoid new high-risk investments. Consider a high-yield savings account instead of a stock splurge.

2️⃣ Middle-Income Suburban Families: Protect and Preserve

Example Scenario: Dual-income household, kids in school, mortgage in the suburbs.

Earning

Diversify income streams: Think side hustles like freelance consulting, tutoring, or starting an e-commerce business. Suburbanites often have more space—consider renting out a room or running a small home-based business.

Saving

Aim for 3-6 months’ worth of expenses. Review your insurance policies—home, auto, life—and make sure you’re covered without overpaying.

Spending

Go through your budget with a fine-tooth comb. Can you renegotiate utility rates? What about meal planning to cut grocery bills? Consider joining a wholesale club to stock up on essentials.

Investing

Continue retirement savings but adjust your risk tolerance. Diversify: bonds, index funds, and stable dividend-paying stocks become your best friends during uncertain times.

3️⃣ High-Income Professionals: Strategic Positioning

Example Scenario: You’re a high-earning city dweller with investments and multiple assets.

Earning

Now’s the time to shore up professional security. Networking is critical—build stronger ties with your industry peers. Consider diversifying into consulting or advisory roles to hedge against job instability.

Saving

Your emergency fund should be at least 12 months of living expenses. This isn’t just for you; it’s to cover extended family or others who might depend on you.

Spending

Review luxury expenses. Can your gym membership be frozen? Could you swap an overseas trip for a local adventure? Even high-earners need to be cautious in a downturn.

Investing

While others retreat, you have the chance to buy undervalued assets. Keep cash reserves ready to take advantage of market dips—but be methodical, not impulsive.

Affiliate idea: Books on contrarian investing (e.g., “The Intelligent Investor”), or personal finance software.

4️⃣ Rural and Small-Town Workers: Resourcefulness Rules

Example Scenario: You work in agriculture, trades, or local services, and you live in a rural area.

Earning

Local economies can be surprisingly resilient, but finding alternative income streams is smart. Sell homemade goods, offer handyman services, or teach a skill online.

Saving

Leverage community resources: food banks, co-ops, and community gardens. Build a cushion, but also think in terms of barter and mutual aid—things that flourish in tight-knit areas.

Spending

Stock up on essentials before prices rise. Rural folks often already have a DIY spirit, so double down: grow more of your own food, repair instead of replace.

Investing

Prioritize paying off high-interest debt. Investing might take a backseat until you’re on stable footing, but if you can, focus on land improvements or durable goods.

Special Considerations

For Gig Workers and Freelancers

Gig economy workers face unique challenges. Use apps that provide invoicing and budgeting tools (Amazon link idea: financial planners or apps).

- Save 20-30% of income for taxes and unexpected downtimes.

- Diversify clients as much as possible to avoid dependency on one platform.

For Retirees

If you’re retired, make sure your investment mix is conservative. Prioritize income-producing assets and keep 1-2 years’ worth of expenses in cash or equivalents.

Geographic Twist: Coastal vs. Inland

- Coastal Areas: Prone to real estate price swings. Watch property markets closely and have an exit plan if you’re over-leveraged.

- Inland Regions: Often more stable housing prices but may face job scarcity. Build networks that expand beyond your immediate town.

Bonus: Build a Recession-Ready Home Kit

A well-stocked home can save you money and stress during hard times. Consider:

- Basic emergency supplies (water filters, canned food)

- Medical kits

- Home repair tools

- Cook-from-scratch essentials

Final Thoughts: Mindset Matters Most

No matter where you live or your income bracket, the most powerful tool you have is your mindset. Stay proactive, stay informed, and keep learning. A recession doesn’t have to spell disaster—it can be a time of transformation and growth if you prepare wisely.

Related Reads:

- “Your Money or Your Life” (Amazon affiliate)

- “The Total Money Makeover” (Amazon affiliate)

- Emergency Preparedness: The DIY Guide (Amazon affiliate)

R. A. Goldston, CPA at Large